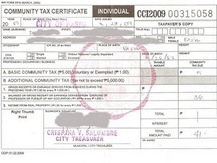

History of Community Tax Certificate

The history of the community tax certificate entails three incarnations dating back to Spanish colonial times.

Introduced in an 19th-century reform of the tax system which followed the Revolt Against the Tribute of 1589 which scrapped the system of tribute, as well as subsequent tax reforms, the cédula was issued to all indios between the ages of 18 and 60 upon payment of a residence tax of eight reales or its equivalent in goods, and was paid annually. This tax was later increased to fifteen reales. When the peso fuerte was introduced in 1854, the residence tax became one peso fuerte and seven reales.

The cédula would play an important role in the Philippine Revolution, when Andrés Bonifacio and fellow members of the Katipunan tore up their residence certificates in defiance of Spanish rule during a meeting in Balintawak (present-day Quezon City). This would be known as the Cry of Pugadlawin and signaled the beginning of the Philippine Revolution.

The residence tax, and in turn, the cédula, were abolished with the coming of American rule. No such tax would be imposed again until January 1, 1940, when Commonwealth Act No. 465 went into effect, mandating the imposition of a base residence tax of fifty centavos and an additional tax of one peso based on factors such as income and real estate holdings. The payment of this tax would merit the issue of a residence certificate. However, persons who are ineligible to pay the residence tax may be issued a certificate for twenty centavos. Corporations were also subject to the residence tax.

Commonwealth Act No. 465 mandated that the High Commissioner and his staff, members and employees of the United States Armed Forces, visitors and consular staff were exempt from paying the residence tax, and as such are not given a residence certicate.

Following Philippine independence, the same provisions were kept in effect. However, the changing socio-political climate necessitated the reform of certain provisions of Commonwealth Act No. 465. Significant amendments to the residence tax law were put into effect first in 1973, following the enactment of the Local Tax Code, with amendments on the allocation of the residence tax and on who are covered under it, as well as payment provisions. The same provisions from the Local Tax Code were later subsumed into the Local Government Code of 1991. However, following the pull-out of U.S. forces from the Philippines, community tax exemptions on United States military personnel were likewise abolished, and the residence tax and residence certificate were renamed into the current community tax and community tax certificate.

Introduced in an 19th-century reform of the tax system which followed the Revolt Against the Tribute of 1589 which scrapped the system of tribute, as well as subsequent tax reforms, the cédula was issued to all indios between the ages of 18 and 60 upon payment of a residence tax of eight reales or its equivalent in goods, and was paid annually. This tax was later increased to fifteen reales. When the peso fuerte was introduced in 1854, the residence tax became one peso fuerte and seven reales.

The cédula would play an important role in the Philippine Revolution, when Andrés Bonifacio and fellow members of the Katipunan tore up their residence certificates in defiance of Spanish rule during a meeting in Balintawak (present-day Quezon City). This would be known as the Cry of Pugadlawin and signaled the beginning of the Philippine Revolution.

The residence tax, and in turn, the cédula, were abolished with the coming of American rule. No such tax would be imposed again until January 1, 1940, when Commonwealth Act No. 465 went into effect, mandating the imposition of a base residence tax of fifty centavos and an additional tax of one peso based on factors such as income and real estate holdings. The payment of this tax would merit the issue of a residence certificate. However, persons who are ineligible to pay the residence tax may be issued a certificate for twenty centavos. Corporations were also subject to the residence tax.

Commonwealth Act No. 465 mandated that the High Commissioner and his staff, members and employees of the United States Armed Forces, visitors and consular staff were exempt from paying the residence tax, and as such are not given a residence certicate.

Following Philippine independence, the same provisions were kept in effect. However, the changing socio-political climate necessitated the reform of certain provisions of Commonwealth Act No. 465. Significant amendments to the residence tax law were put into effect first in 1973, following the enactment of the Local Tax Code, with amendments on the allocation of the residence tax and on who are covered under it, as well as payment provisions. The same provisions from the Local Tax Code were later subsumed into the Local Government Code of 1991. However, following the pull-out of U.S. forces from the Philippines, community tax exemptions on United States military personnel were likewise abolished, and the residence tax and residence certificate were renamed into the current community tax and community tax certificate.